YouTube disclosures finally shed some light the video giant’s advertising trend.

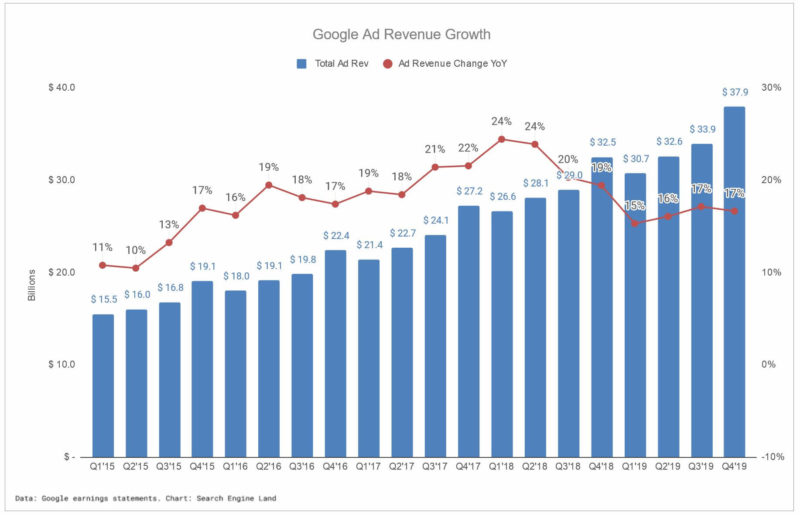

Google reported revenues of $45.8 billion, up 17% year-over-year for the fourth quarter of 2019 on Monday. Including “other bets,” Google’s parent Alphabet reported total revenues grew 23% to $46.1 billion for the quarter. For the first time, the company disclosed YouTube advertising (and Cloud) revenues. It was also Sundar Pichai’s first earnings release since becoming Alphabet CEO.

Google Q4 advertising highlights:

- Google search and other advertising revenues were $27.2 billion for the quarter, an increase of 17% year-over-year.

- YouTube generated $4.7 billion in advertising revenue in the fourth quarter, up 31%.

- Network advertising revenues were $6.0 billion, up 8%. The company said shifted its ad mix to favor Google properties and that growth in this segment was led by Google Ad Manager.

YouTube growing fastest, but still smallest share. Google has long been saying YouTube advertising has been growing, but we haven’t had an insights into just how much it contributes, until now.

Google reported annual YouTube advertising revenues of $15.1 billion, or 11% of total ad revenues in 2019. That compares to a whopping 72% share for Google Search and Other (includes Maps, Gmail, Play and Shopping) at $98.1 billion and 16% share from Google Network Members’ properties (third-party publisher sites), which generated $21.6 billion in 2019.

Google search & Other revenues grew by 15% year-over-year in 2019, while YouTube ad revenues increased by 36% for the year. Network revenues grew by just 8% compared to the previous year.

Expect more commerce advertising on YouTube. Brand advertising continues to account for the majority of ad spend on YouTube, but direct response is growing faster, executives said. In early November, Google opened up YouTube inventory on the home feed and in search results to Shopping ads.

“I think direct response is a huge growth area for us,” said Pichai on the earnings call. “And increasingly, I think when you look at the fact that people are consuming a lot of goods and services as part of their experience in YouTube, how can we create better commerce experiences also is a big opportunity for us.”

In January, Google brought in former PayPal COO Bill Ready to head up Commerce products, and Ready will be working closing with advertising teams.

In addition, YouTube “now has over 20 million Music and Premium paid subscribers, and over 2 million YouTube TV paid subscribers — ending 2019 at a $3 billion annual run rate in YouTube subscriptions and other non-advertising revenues,” Pichai said.

Shopping Actions participation grew. The ability for users to “Buy on Google” — indicated by shopping cart logos on Shopping ads — is a major focus on the revamped Google Shopping experience in the U.S. It’s powered by Google Shopping Actions, and the company said the number of U.S. merchants participating in that program has increased four-fold.

“Throughout the entire holiday shopping season, we also expanded the selection of products on Google due to a 4x uptick in the number of US merchants participating in our Shopping Actions program.”

Record shopping search touted. “Over the Black Friday and Cyber Monday holiday weekend, we had the largest number of daily shoppers on Google.com ever in our history,” Pichai noted. Google has been facing pressure from the rapid growth of Amazon’s advertising business (even if still relatively small) as well as from social commerce offerings from the likes of Instagram and other platforms.

CPC declines slowing on Google properties. The company said growing engagement with YouTube ads “where cost-per-click remains lower than on our other advertising platforms” continued to contribute to overall lower cost-per click down across Google properties. However, the declines have lessened significantly this year. For 2019, CPCs on Google properties were off by just 7 percent compared to 25% drop year-over-year in 2018.