“Disney’s got an awful lot to work with but Netflix is damn formidable,” says former NBC Cable President and Tivo CEO Tom Rogers. “It missed its estimates last quarter which has clearly wreaked some havoc with the stock. They also double downed and said they were confident that they were going to be hitting about 30 million new subscribers for the year. Netflix, just to put that in perspective, it took HBO about 30 years to get 30 million subscribers. Netflix is going to add an incremental 30 million globally in a year. Netflix is really really formidable.”

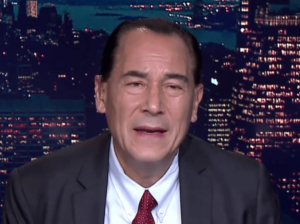

Tom Rogers, media visionary and Executive Chairman of WinView Games and CEO of TRget Media discussed how Netflix will remain number one against Disney+ in an interview on CNBC:

Netflix Is Damn Formidable

Disney is a formidable company. The theme park opening is just one more example of how extensive their intellectual property is, how great their brands are, and what a great management team they have. Not only Bob Iger but the man charged with transforming the company in terms of streaming Kevin Mayer. Disney’s got an awful lot to work with but Netflix is damn formidable. It really is. It missed its estimates last quarter which has clearly wreaked some havoc with the stock.

They also double downed and said they were confident that they were going to be hitting about 30 million new subscribers for the year. Netflix, just to put that in perspective, it took HBO about 30 years to get 30 million subscribers. Netflix is going to add an incremental 30 million globally in a year. Netflix is really really formidable. I don’t think Disney’s prospects are really all about how much it can do vis-à-vis Netflix, it’s about how much it’s going to do relative to all the other players coming into the streaming world.

It’s Not Going To Get Better For Traditional Television Bundles

We just hit the highest cord-cutting quarter in the history of cable and satellite. It doesn’t look like it’s going to get better for traditional television bundles. What people expected as that happened was subscribers would start going to these so-called skinny bundles that Hulu TV offers, YouTube TV offers, and Sling offers. Cheaper smaller packages of channels. But those have clearly not done as well as people thought even though they’re much cheaper at $50 versus $80 to $100 for your cable satellite bundle.

We are seeing some price resistance set in here and price resistance at levels that’s bigger than what people thought. There is going to be a limit as to how many streaming services people are going to take. Netflix with almost 60 million domestic streaming subs, I don’t think they’re going to be the ones that people are going to disconnect. Their original programming budget for television is just so high that they always have new fresh material coming on board. I think the other players who are spending in the $1 billion to $2 billion or so in originals a year, that’s where the competition is going to be for who’s going to be the second, third, or fourth kind of player.

Can Disney’s Film Library Really Power Their Streaming Service?

Disney making the decision to bundle Hulu, Disney+, and ESPN+ at a very subscriber friendly price of about $13 a month is going to have a huge advantage there as well as with their brands to really be in that second position. But look, movies that have run their course in the theaters are not necessarily the game-changer for attracting people to streaming services. Netflix has had a lot of Disney films and you don’t hear people talking about the Disney films on Netflix. I’m talking about the originals.

It’s going to be interesting to see if Disney can really leverage that film library even though things have run their course in the theater and make that really a basis for the streaming service taking off.

Disney Has To Make Up Massive Cable TV Subscriber Losses

Disney can make money at $13 a month but what the investor world I think is largely missing is the amount of downdraft they have to deal with on the traditional channel business. When you look at ESPN at about $8 per sub that it gets from cable and satellite and you put together the other services of Disney and the ones they acquired from Fox and you’re talking $18 dollars a month that they get from cable and satellite. The expectations are that the linear television channel world, our traditional TV channels, are going to lose some 20 million subs or so over the next five years. To make up that $18 a month with $13 a month streaming bundles you have to get to about 30 million new streaming bundle subs to just make up for what you’ve lost on the traditional TV side.

Disney’s already been awarded about a $40 billion dollar market cap increase since it announced its streaming plans in April. A lot of that is excitement on the growth of the streaming but you’ve got to take into account how much the traditional TV world is going to be disrupted and all that decline.

A Huge Audience Wants Its Television Commercial-Free

Certainly, a lot of TiVo’s success was all about how do I skip through commercials. There’s a huge audience out there that wants its television commercial-free. A lot of the Netflix experience and a lot of the Amazon Prime experience gives me all the entertainment I want on-demand with no commercials there. But Hulu has had some real success having a lower price and putting ads into it. Disney is actually claiming that the delta between the no advertising price and the price you pay if you get ads, the value of that advertising they’re putting in there makes up and more for that delta.

It does look like there are consumers who will be willing to pay a lower price and take the ads. I think they’ve got to be very careful not to stuff the ads in there like with linear television. You’ve had a number of services that I think have chased people to Netflix and the non-commercial services because the commercial loads have gotten too high. So I think they’re going to be limits as to just how much they can get from advertising revenue there. Certainly it’s going to be an option popular with a number of consumers.